It doesn’t take an economist to see how much copper prices have changed recently.

Copper is, on average, trading about 80 cents higher today than last year. At one point in late May, the industry’s supply chain struggles saw per pound copper prices top $5, setting milestone highs.

Of course, higher material and product prices are nothing new. Inflation rates are still higher than in previous years, and despite cooling over the last year or so, we’re still paying more.

Like many traded commodities, copper is unique. Supply and demand metrics can drastically impact how much we pay for it, and one slip can send prices soaring.

But with prices reaching historic highs and supply concerns taking center stage, is copper entering a new supercycle?

It might sound like something a five-year-old would call their bike, but supercycles are a critical time for commodities.

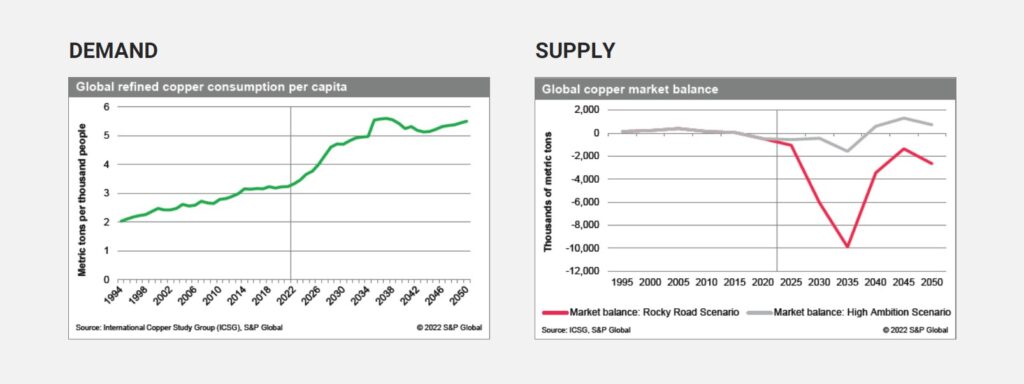

The thing to understand about supercycles is that they can last for years. Typically, commodities enter supercycles when there’s a long-term supply and demand imbalance. But what does a long-term imbalance look like for copper?

In this case, demand for copper products and materials is outpacing supplies. As a result, there’s less copper available on the market, causing prices to soar. When a supercycle occurs, it increases stock prices and signals long-term commodity growth.

Long story short – supercycles are good because they signal higher demand, more innovation, and economic growth.

For a supercycle to occur, a few scenarios have to happen.

First, there needs to be an event or action causing demand to grow. The last globally accepted supercycle peaked in the early-mid 2000s, thanks to China’s industrialization and urbanization boom. The economic boom lasted from the late 1990s until the 2010s when global growth slowed.

The supercycle process starts with a geopolitical action that decreases supply or increases demand, extreme economic growth, or technological innovation. But even with these factors in play, we still need a spark to set the fire.

If increased demand is one side of the equation, then decreased supply is the other. Unfortunately, both must happen simultaneously to potentially trigger a supercycle. Copper demand is taking off as more countries and companies invest in renewable technology. Additionally, the rise of artificial intelligence is leading to more data centers.

Copper is critical to both initiatives, but supplies aren’t matching needs. United States Geological Survey data shows copper production was flat in 2023, at about 22 million metric tons. As demand rises, supplies need to follow suit. If they don’t, prices rise as companies clamor for materials and products.

As copper supplies struggle to keep up with skyrocketing demand, we inch closer to the start of a supercycle. When these two events happen together, prices immediately spike because of constrained supply.

Let’s look at today’s global copper supply chain and market. We’re seeing a massive uptick in demand growth due to renewable energy goals and technological innovation. As we use more copper, it strains current supplies. Mining companies can’t source raw materials out of thin air, and it can take years to increase mining operations.

While companies struggle to bring mines online and find copper hidden underground, demand keeps growing. Populations increase, electrification and urbanization continue, and technology gets more powerful.

Although we can’t predict when a supercycle might happen, we can read the tea leaves for clues. Though a single global variable may not affect supply and demand much, several at the same time can quickly inflate costs.

The short answer is we don’t know, but some experts believe the writing is on the wall and a new supercycle is imminent.

Global market prices are reaching new highs based on a massive influx of new demand. The world is investing money in electric vehicles (EVs), renewable energy, including wind and solar, and global electrification projects. While it’s welcome news for the environment, it is straining the shaky supply chain.

The average EV has about 183 pounds of copper, far more than a standard gas-powered car. For reference, a gas vehicle only has about 48 pounds of copper, while hybrids have about 88. Throw in the copper used to power EV charging stations, and it’s easy to see how growth might eat up current supply.

Renewable energy also uses an incredible amount of copper wire. Data from Navigant Research suggests a 1 MW solar farm uses about 5.5 tons of copper. With more solar installations coming online, the need for copper expands.

We’re also seeing the rise of copper in data centers, where the metal is a cost-effective alternative to fiber optic cable. It also has uses across electrical and data applications, providing good signal quality, low latency, and efficient energy use.

What is a supply chain manager’s most arduous task?

It might be trying to source materials when the global economy is expanding.

But solving the issue isn’t as simple as going out and digging up more copper. Copper grades (quality) have been slipping for years, making it harder to find and extract high-grade ore. It can also take over a decade, and sometimes two decades, to open a new mine.

Additionally, mining companies must navigate seemingly endless regulations and environmental concerns that delay mine openings. The world is trying to balance innovation and production with ecological stewardship, leaving the copper market scrambling for solutions to please both sides.

Finally, recycling is improving but has room to grow. In 2023, recycled copper formed about one-third of the total U.S. supply, including about 700,000 tons of manufacturing scrap.

Global politics are scattered, with trade disputes, wars, and political instability affecting commodity markets.

China is by far the world’s largest copper smelter, refining 12 million tons of the metal in 2023. The country is also going toe-to-toe with the United States on trade disputes, which could lead to tariff changes.

The Ongoing war in Ukraine and attacks on the Red Sea are impacting supply chains. Shippers have already had to change routes to avoid both regions, adding time and costs to every trip.

Political instability in South America, including Chile and Peru, could reduce copper production. Both countries are navigating choppy political waters, balancing environmental stewardship with a large-scale economic driver.

In each scenario, copper supplies could become constrained. When this happens, raw materials and finished products take longer to hit the market, resulting in higher prices.

Despite incredible uncertainty, the industry can change course and stabilize copper supplies.

Streamline Mine Opening Processes

Navigating red tape can take years, but simplifying permitting can speed up new mine development. Streamlined permitting allows companies to move faster while protecting and addressing environmental concerns.

Improve Mining Practices

Better mining practices and methods can improve copper extraction without new mines. When ore grades are poor and processes are inefficient, it costs more to source copper. Innovations and improvements increase mine efficiency and optimize ore-gathering processes.

Get Better at Recycling

New mines aren’t opening overnight, making recycling an attractive choice. Everything has a shelf life, and recovering metals from scrap products and materials will soon be a top priority.

Suitable Replacements

Copper is conductive, low-cost, and easy to work with, but so is aluminum. Unfortunately, the knock against aluminum is that it isn’t as conductive, meaning projects need larger gauge wires. However, it’s a lightweight and low-cost copper replacement despite needing larger wires.

Our insatiable need for copper isn’t slowing down.

The world is advancing with new technologies, renewable energy sources, and a powerful push for globalization. Those initiatives improve the world but may also create a supercycle. If that happens, it’s up to the copper industry and global community to find the best approach and make it work.

Otherwise, we’re looking at short-term struggles and long-term price hikes.