When the Department of Energy (DOE) released its 2023 Critical Materials Assessment in July, it seemed the tide was finally turning on the copper debate.

A few months prior, in March, the United States Geological Survey (USGS) left the reddish metal off its critical materials list. The move sparked questions and concerns from government officials, industry experts, and trade groups, prompting the agency to address the omission.

So, what changed, and is this a sign of things to come for copper miners, producers, manufacturers, and others?

When the DOE released its list of critical minerals, copper was listed alongside other metals, minerals, and rare earth elements, including Cobalt, Gallium, Uranium, Aluminum, Nickel, and Silicon.

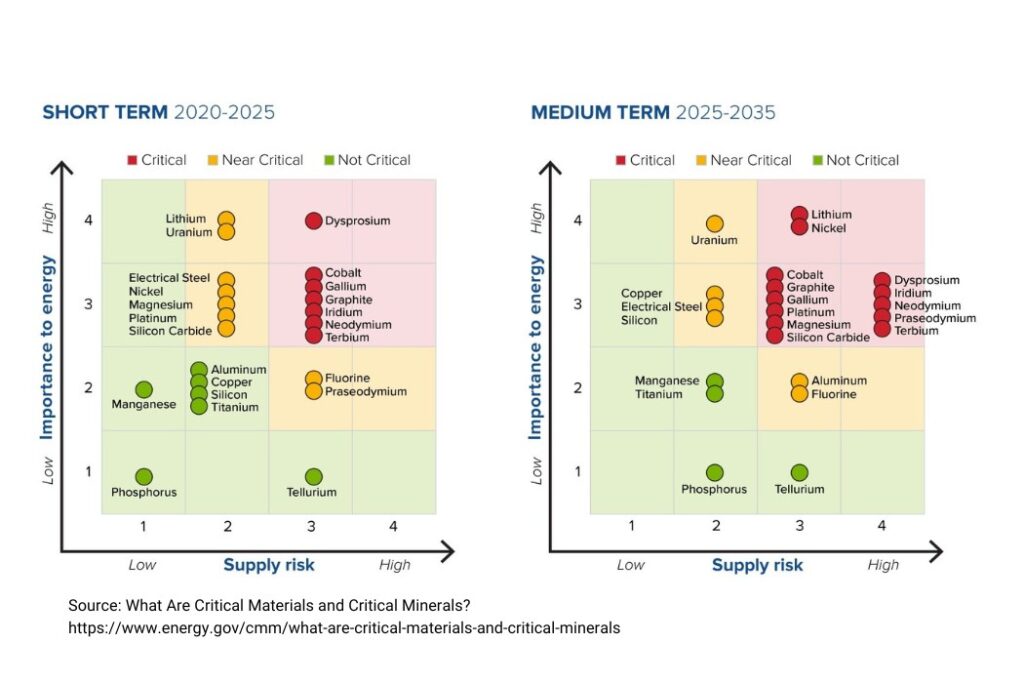

The DOE also believes copper will become more critical over time. In its short-term measurement, copper was classified as not critical, drawing the same risk as aluminum, silicon, and titanium. Looking further into the future, copper is more crucial, with the agency saying, “Major materials like aluminum (Al), copper (Cu), nickel (Ni), and silicon (Si) move from noncritical in the short term to near critical in the medium term due to their importance in electrification.”

Besides electrification, copper demand applies to many applications, including solar energy technology, wind turbines, electric vehicles, and other renewable energy initiatives.

In stark comparison, the USGS’ comments showed less concern. According to the scientific agency, “Copper is an important host mineral for other critical minerals, including cobalt, however domestic production mitigates its supply chain vulnerability. Supply risk for copper has been increasing in recent years and it merits watching.”

So, if we know copper is necessary, why do we have two different answers? Is the DOE’s assessment the first domino to fall, leading to a government-wide shift toward prioritizing copper? If so, what is the next step for the U.S. and the global community?

No one has been immune to copper’s recent growing pains.

Between the volatile pricing we saw in early 2022 and supply chain questions involving overseas shipments, copper has become a focal point globally. The Copper Development Association (CDA), an industry trade group, cheered the DOE’s move, noting, “for the first time, a U.S. federal agency is following the lead of the EU, Canada, Japan, India, China and others by characterizing copper as critical through its inclusion on the official DOE Critical Materials List.”

For example, Canada has taken steps toward addressing its copper strategy. In the country’s 2022 Critical Minerals Strategy report, authors noted, “Critical minerals are the building blocks for the green and digital economy. There is no energy transition without critical minerals: no batteries, no electric cars, no wind turbines and no solar panels. The sun provides raw energy, but electricity flows through copper.”

Canada’s strategy is one the U.S. shares, as both countries push toward renewable energy goals. Copper is a vital mineral resource for many industries, including clean energy, EVs (Electric vehicles), wire and cable, energy storage, plumbing, medical devices, and cookware.

But so many uses create drawbacks, too. Copper consumption has steadily increased over the past 20 years and isn’t slowing down. Experts at S&P Global believe demand could double to nearly 50 MMt (Million Metric Tonnes) in 2035 and plateau at 53 MMt by 2050. 2050 is the deadline for some nations’ renewable energy and net-zero goals.

It seems like a no-brainer but adding copper to any U.S.-supported critical mineral list is big news.

First, it means the United States takes the metal’s future role seriously. As we increase annual copper demand to meet emerging needs and support existing ones, the strain on natural resources will pressure mining and processing companies to keep up. Government support potentially means funding for research and development, innovation, and material sourcing to keep projects going.

Secondly, its recognition as a critical mineral acknowledges increasing competition. Humanity has only produced about 700 MMt of copper since mining began but billions of metric tons of copper deposits are available. The USGS has speculated that more than 5.6 billion metric tons of copper, identified and undiscovered, haven’t been mined.

Although the United States has mines, it’s not the largest copper producer. Chile holds that title, producing about 29 percent of the world’s copper, and Peru is second. Luckily, more government help means we can strike better deals with producing countries and secure consistent copper supplies.

Lastly, elevating copper’s importance shows the government is serious about green technology and renewable energy. Copper is a crucial part of many products, from the components in electric vehicles and wind turbines to solar panels, PV wire, and more. Without it, these products would be less reliable, efficient, and cost-effective.

The DOE is only one agency, but this could be the first step toward acting on a full-fledged copper strategy.

But what does that strategy look like?

Demand for copper isn’t slowing down – but production isn’t increasing as much as we thought, either.

The easiest way to bolster the copper supply is to grow domestic production. Tax breaks and simplified bureaucratic processes can make copper mining more attractive, helping companies open or expand mines.

More money also means more research and development. R&D can lead to finding new mines, better extraction technology, and better environmental efforts.

Recycling will heavily affect the future copper landscape – especially if mining and production lag behind demand.

The USGS estimates about one-third of the U.S. copper supply in 2022 came from recovered scrap. With more government support, it’s possible to increase recycling rates through public awareness campaigns and support emerging technologies to improve current processes.

Chile is the world’s largest copper producer, and Peru is a distant second, but China is the largest copper refiner by a landslide.

The U.S. can establish stronger trade relationships with other countries by reducing red tape like tariffs and duties. American companies can also directly invest in other countries by partnering with existing companies or building new facilities. An example could be an American mining company investing in new road infrastructure to improve the areas around mines.

Copper is an excellent conductor, but what if we need to find other solutions?

Aluminum is a common lightweight alternative to copper but is less conductive. It’s still a viable choice for radiators, tubing in refrigerators and air conditioners, electrical systems, and power cables.

Other materials like titanium and steel could work in heat exchangers, while fiber optic cable is becoming the choice for telecom solutions. Meanwhile, plastic has become a lightweight and durable answer for drains, plumbing, and water pipes.

Not every substitute is an upgrade, but they can quickly fill voids caused by shortages.

Everyone knows the goal – transitioning away from fossil fuels – but how we get there is entirely up to us. The global economy moves fast, opening doors for collaboration and stronger partnerships. Those partnerships will go a long way when supplies and competition tighten in the coming years.

In the meantime, the government needs to find innovative ways to improve domestic mining and production. By reducing red tape and barriers to entry, we can maintain steady copper prices and supplies and set ourselves up for a brighter future.

As a copper wire manufacturer, Kris-Tech is excited about the DOE’s decision. The announcement is a major step toward proactively addressing a significant issue.