It might not always seem like it, but 2024 has been a good year for the U.S. supply chain.

Despite everything in the news about global conflicts, rising tension, and inflation fears, there are still plenty of hopeful signs.

Though it isn’t perfect, the U.S. shipping situation has improved over the past six months. But will the good news sweep into 2025, or will looming issues throw a wrench into the machine?

Kris-Tech Wire sat down with Paul Wright, Logistics Performance Director for BlueGrace, a full-service Third-Party Logistics (3PL) provider, to talk trucking, shipping, and everything supply chain.

When we closed out 2023, inflation was a threat, Yellow Trucking had shut down, and diesel prices were well past $4.25 per gallon.

Today, we can tell a much more positive story. Inflation is softening, prompting the Fed to consider its first interest rate decrease since 2020. Many of Yellow Trucking’s nearly 200 terminals have new owners with other carriers, adding capacity to the supply chain.

Diesel prices, though still higher than they were pre-pandemic, have slipped below $4 per gallon, sitting at $3.77/gallon at the end of July.

“Domestic transportation here in the U.S. is flowing well,” Wright explained. “Truckload rates have been stable for the past year, fluctuating between $2.05 and $2.10 a mile. The stability is great for us, especially diesel fuel, which is a big factor.

Fuel can take up about 20-25% of the cost of transportation, but it’s lower than what the government predicted. They predicted it to be $4 per gallon for this year.”

Within the trucking industry, less-than-truckload (LTL) freight shipping has seen a boost in 2024.

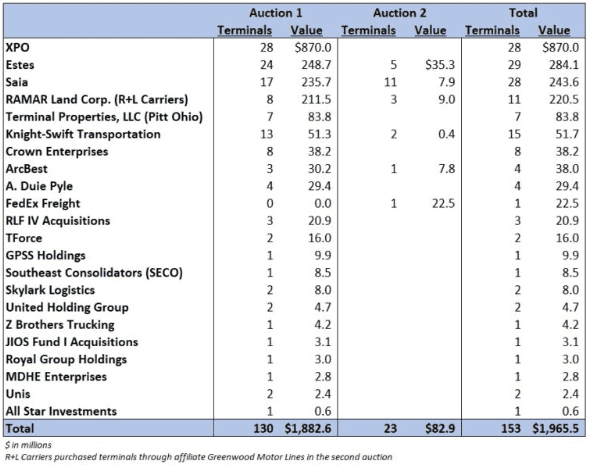

When Yellow Trucking declared bankruptcy in the summer of 2023, it was the fourth-largest LTL carrier in the U.S., employing 30,000 people. Since then, other carriers have swooped in to purchase its facilities and trucks, expanding their territory and market share (see chart).

“Many of Yellow’s facilities have been purchased by other carriers, and they’ve started opening them,” Wright said. “That’s great news because capacity should be much better – there will be more room on trucks, and services should get better. Eventually, freight rates will stabilize and potentially go down.”

Though it’s good news, Wright admits overall freight prices won’t decrease. Rather, we’ll see a decline from previous double-digit rate increases to a more expected rise.

“If you look at year-over-year rate increases, they’re almost 11% higher than last year,” Wright explained. “Normally, the general rate increase for LTL carriers is about 4 to 5%. But we’ve seen upwards of 10% or more for the past two years. We believe things will stabilize as these carriers reopen former Yellow facilities.”

Meanwhile, the nation’s number one freight carrier, FedEx Freight, may branch from the larger company. The move is similar to one UPS made a couple years ago. When UPS sold UPS Freight to TFI International, the company rebranded as TForce Freight. Although there were a few early hiccups, the company has found its footing and is the sixth-largest carrier by revenue.

Though the domestic news is good, brewing international issues have become a concern.

The year began with the ongoing war in Ukraine and pirate attacks in the Red Sea, a crucial pathway to the Suez Canal. We then navigated fears about the Panama Canal’s water levels and rising tension in the Middle East.

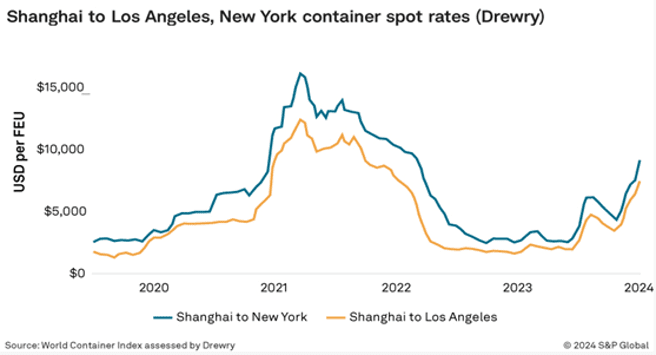

“The main issue in the supply chain today is the conflict in the Middle East, which is affecting container traffic through the Red Sea,” Wright said. “Thirty percent of the world’s container traffic uses the Red Sea. Attacks on container ships have forced shippers to use a much longer route around Africa, increasing transit time, shipping rates, and insurance costs. Shipping rates have almost tripled this year.”

As conditions change, so will global supply chain methods. This could mean drastic changes in transportation costs, delivery times, and overall freight costs for overseas products.

The high price of ocean shipping is forcing United States manufacturers and companies to find cost-effective ways of sourcing raw materials and finished products.

Often, it means ordering more products earlier to ensure availability.

“They’re pulling ahead of their orders,” Wright explained. “But they have to be careful because they will have inventory carrying costs and potentially some obsolete inventory. Still, containers coming into the U.S. have increased to almost what they were right after the pandemic, 2021-2022, and much higher than before the pandemic.”

Wright anticipates that increased turmoil in the Middle East could continue into 2025, keeping ocean rates high and slowing down shipments.

Additionally, fears of higher import tariffs are forcing companies to frontload orders as a cost-saving measure. President Biden has already issued new tariffs on several products, including electric vehicle batteries and computer chips. However, some worry there could be repercussions from the Asian powerhouse.

Another issue to watch is the rising threat of a longshoreman strike along East Coast and Gulf Coast ports. Contract negotiations have not progressed, prompting the International Longshoremen’s Association (ILA) to consider a strike once their agreement expires on September 30.

A potential strike could force companies to use West Coast ports and ship goods via rail or truck to their final destinations.

Not everything is doom and gloom for the domestic supply chain, though.

Freight shipment costs from China are slowly backing off from recent highs, offering some relief to shippers and companies. Though they’re still higher than in recent years, the slight drop is a good sign for 2025.

“We’ve seen a cost drop over the past two weeks,” Wright explained. “The spot rate for Shanghai to New York was about $9,610 for a 40-foot container two weeks ago. Since then, it dropped to $9,200, and the average this week is $9,100.

The same situation is happening for shipments traveling from Shanghai to Los Angeles. Spot prices were $7,200, then dropped to $6,900, and now are $6,700 on average. Prices are coming down, and hopefully, it’s a trend we’ll continue to see.”

Post-pandemic growth coinciding with Yellow’s closure last year tightened up less-than-truckload (LTL) capacity across the United States. Today, the situation is looking up.

Other trucking companies are buying and reopening Yellow’s facilities and purchasing the company’s tractors and trailers. As a result, prices are slowly falling back toward what industry experts expect them to be.

“Hopefully, they’ll try to stabilize rates or potentially see some reductions,” Wright said. “I don’t see pricing changing until the fourth quarter, so everything should be stable. Maybe the fourth quarter could be a good time for companies to go to the marketplace and see if rates are better than what they’re paying today.”

The average LTL contract is currently up 10.6% year-over-year but could slow as Yellow facilities come online. BlueGrace estimates rates will return to their predicted 5-7% increase in 2025.

At the same time, the truck driver shortage has become a way of life for the domestic shipping industry. Despite losing another 30,000 positions in the past year, shippers have little trouble finding trucks to move their materials.

“When Yellow went out of business last year, many drivers were obviously put out of work,” Wright said. “They’re now being rehired at other companies.”

Another shipper, Knight-Swift, is increasing service and expanding LTL shipment options alongside its already large truckload service.

Long story short, domestic shipping is doing well, all things considered.

With that said, Wright has a few tips for maintaining supply chain resilience.

Overall, domestic shipping has improved immensely over the past year but could easily get rocked by external forces. For example, if tensions in the Middle East boil over, it could dramatically impact global shipping. Domestically, an unexpected company shutdown or cyber threat could derail critical shipping lines.

But right now, supply chain operations are improving, and in 2025, we can expect a bit more long-term normalcy.