If you’ve ever gone shopping for the latest toys and gadgets on Black Friday, it’s likely you’ve been part of a bullwhip effect.

While it has nothing to do with cowboys and rodeos, this supply chain phenomenon can pack a serious punch. More importantly, no industry is immune from its impact, as it all comes down to consumer demand.

So, what is a bullwhip effect, why does it occur, and how can supply chain managers avoid getting caught in one?

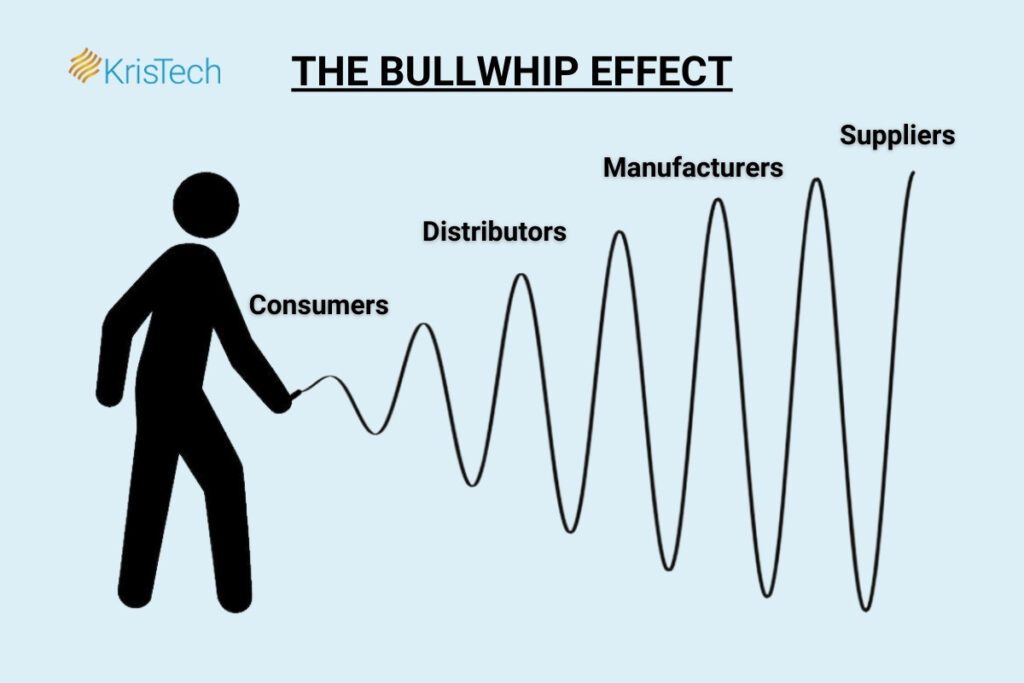

The bullwhip effect occurs when small changes in customer demand cause bigger reactions in the supply chain. This can lead companies to overreact by over or under ordering or producing to prevent stock problems.

When businesses close to the consumer use inaccurate real-time data to predict demand, it creates ripple effects impacting the entire supply chain.

Generally, bullwhips start with a consumer demand increase or decrease. Retailers or distributors react to the change in buyer behavior by ordering more or less of the product. Manufacturers, seeing the change in distributor orders, modify production to cover the purchasing change. Finally, suppliers react to the manufacturers’ changing methods by sourcing more or less raw material.

At first glance, this sounds like a simple supply and demand issue, but there’s slightly more to it than that.

For example, let’s say a B-List celebrity from an 80s show everyone forgot about starts hawking a new type of golf cart. Consumers see the ad, and immediately stop at their nearest retailer to buy the cart. Within weeks, cart sales are up 10%, but the retailer is now afraid of running low on carts. To avoid losing out on sales, they make the call to increase their orders by 15%.

“Promotions can be a large driver of bullwhip events,” KrisTech’s Supply Chain Director Marcus Tagliaferri said. “If the operations side of the business isn’t aware of a promotion sales is driving, overreaction can cause excess supply, hurting costs, cash flow, and relationships.”

But this retailer is only one of many seeing an uptick in golf cart sales, and all of them are hedging their bets to avoid stocking problems. The distributor sees an uptick in sales orders come in, and wanting to avoid stocking issues on their end, increases their order by 25%.

The golf cart craze is in full effect now, as manufacturers start receiving larger orders for the celebrity’s model. Producing more carts will take time and labor, leading to longer lead times and even employee overtime. To avoid running out of stock to send to distributors, the manufacturer bumps their own stock 50%.

Finally, suppliers may boost production to provide manufacturers with the raw materials they need consistently.

The bullwhip has cracked, and everyone is off to the races to meet rising demand. But, like the split second of action we see with a whip crack, the golf cart craze also meets a swift end.

Unfortunately, the celebrity’s star power isn’t all that strong, so golf cart sales flatten again after a couple of months. Comsumers have moved on to some other fad, leaving retailers, distributors, and manufacturers with unsold stock.

And as every supply chain manager knows, unsold stock equates to sunk money.

In the example above, an increase in sales led to a glut of extra products, but that isn’t always the case.

Sometimes, a dip in consumer demand pumps the brakes on orders, leading to drops in production to avoid carrying too much stock. When demand ticks up again, manufacturers may run into long lead times as they pick up production.

This, in turn, makes products scarcer, causing price spikes and stockouts across distributors and retailers.

Unfortunately, in either case, bullwhip effects ripple through the supply chain, causing short-term price fluctuations and inventory management issues. These problems can persist for months, but eventually die down as supply and demand levels return to normal.

At first glance, bullwhip effects look and feel somewhat like the start of a supercycle. Although the two economic trends have some similarities, they’re more different than you might expect.

Bullwhips are generally short-lived supply chain issues caused by a TEMPORARY spike or drop in customer demand. Although the first consumer impact may be small, the effects worsen as you move up the supply chain.

Typically, bullwhips occur when companies make forecasting decisions using bad real-time data. The retailer’s decision becomes a larger problem as it travels up the chain and others overcorrect. After a few months, stock levels even out, production stabilizes, and the waves get less choppy.

Supercycles, meanwhile, are more overarching, affecting global supply chains and industries. They occur when economic, geopolitical, or industry signals create demand spikes resulting in higher long-term prices. For a supercycle to happen, two things need to happen at the same time – high demand and low supply.

Once a supercycle begins, they tend to last for years. This is because the supply chain needs to figure out how to source, manufacture, and bring to market enough stuff to meet rapidly rising demand. Despite higher prices, many experts believe supercycles are a good thing because they support strong economic growth.

Everything in business comes down to money, and the bullwhip effect is no different than any other market shakeup.

Typically, a bullwhip leads to four outcomes, each hurting multiple points in the supply chain.

When retailers, distributors, manufacturers, and supplier rush to secure products, it can sometimes lead to overstocks or stockouts. Overstocks occur when companies buy or make too much product, leading to sunk costs on excessive inventory. Additionally, companies have to spend time, effort, and money marketing less-than-popular products to get them off the shelves.

Stockouts occur when a product isn’t available, forcing customers to find it somewhere else. This happens when a product is popular, but manufacturers and distributors can’t keep up with production.

Production delays occur when manufacturers catch up to meet rising demand.

When demand spikes, seldom are companies fully prepared to retool and jump into a trend. As distributors scramble to find items, manufacturers must work quickly to build buffer stock. This results in added employee overtime, a potential quality drop, and higher costs.

Raw material suppliers may feel the brunt as well, as manufacturer requests require them to find source more production materials.

When products see an unexpected popularity spike, a common response is to increase orders.

The sudden change in orders causes issues in the supply chain. This is because more large orders mean more trucks, more shipments, and more shipping costs. Other problems include delivery delays caused by longer production lead times and an overall lack of products.

“Having lived through some of these bullwhip events, one thing that can happen is it can add stress to Seller-Buyer relationships,” Tagliaferri explained. “In many cases, the buyer wants to push orders out on the seller, and hard discussions can unfold if everyone isn’t on the same page from the start.”

One of the most well-known bullwhips in history happened in the mid-1990s, when Volvo found itself with a glut with green cars. The issue began with a large stock of green cars, which led dealers to offer incentives to get the cars off their lots. Seeing the rise in sales, Volvo responded by manufacturing even more green vehicles, thinking the high sales volume was tied to a genuine interest in the color, not the incentives.

Unfortunately, a lack of communication and bad data made the car company’s problems worse. When Volvo started cranking out new green cars, they largely sat on lots because there simply wasn’t enough demand to meet the supply.

“Communication is critical to maintaining a strong supply chain,” Tagliaferri explained. “When companies aren’t talking to each other, it sets off a chain of events that leaves most people on the losing side of the equation. Tariffs can be another pain point for companies, particularly when companies are trying to bring products in before tariffs kick in.

What we end up seeing in those cases are an influx of import shipments from overseas, which chokes seaports, then delays and strains trucking companies, railroads, and other transporters. Everyone plays catch-up, which lengthens lead times and slows down shipments.”

Despite how common it is, it’s possible to mitigate the bullwhip effect with a few simple tricks.

Oftentimes, preventing problems is as easy as staying on the same page with your partners.

The supply chain doesn’t work without reliable communication.

Retailers should keep their distributors informed about any potential changes they might see. In turn, distributors need to keep manufacturers in the loop, giving them time to prepare for any lulls or spikes in demand.

Better communication throughout the process leads to better decisions and less inaccurate demand forecasting.

No one should be working with one single partner or vendor.

Working with a variety of suppliers, manufacturers, and distributors ensures the product is always available when you need it. On a normal day, multiple suppliers can ensure costs are always competitive. During an emergency, all those partners keep products moving.

Additionally, having multiple options can lessen the negative effects associated with long lead times, quality concerns, and other fears.

Not every minor demand spike or lull is a harbinger of bigger things ahead. Sometimes, it’s just a coincidence, or there’s a larger factor in play.

Maintaining a small safety stock provides a buffer to help companies get through a minor increase in demand. The buffer is nice because it gives companies enough time to talk with other supply chain links to decide the best route to take.

A growing number of companies are using inventory tracking software to intuitively track product sales and trends.

For other large-scale retailers, it may make more sense to allow vendors or distributors to keep track of every location. Doing this reduces the number of links in the supply chain and allows companies to place batch orders on behalf of all locations.

The result is bigger orders, but fewer shipments across the board, reducing prices and maintaining supply.

Manufacturing is all based on forecasted demand, avoiding misspent resources and stale products.

Lean manufacturing, also known as just-in-time (JIT) manufacturing, involves only making products when needed. This reduces inventory and waste, but also improves efficiency and productivity.

Why does all this matter for a manufacturer, especially during a bullwhip event? Because lean manufacturing is all about streamlining processes, manufacturers can quickly pivot to fill holes when needed. The result is high-quality product with a short lead time, leading to better customer service and results.

Bullwhip effects are one of many supply chain phenomena we might see, but we have tools to reduce their crippling impact.

Customers will always follow trends, chase new items, or rediscover old ones. Knowing how to use data can help you spot trends and unusual events, saving you time, money, and stress.

At the end of the day, communication is key. Everyone in the supply chain should be on the same page, anticipating potential issues BEFORE they develop.

When everyone has time to plan for situations, the supply chain remains stable, and the bullwhip is less effective.